As a regional solution to local economic development needs, SENDD provides several programs and services to help existing and start-up businesses across the 16-county service area, including Revolving Loan Funds, technical assistance, and a new Regional Economic Development Lite Program that offers communities with education about economic development and the tools necessary to address their economic development needs. Below are a list of services SENDD provides –

As a regional solution to local economic development needs, SENDD provides several programs and services to help existing and start-up businesses across the 16-county service area, including Revolving Loan Funds, technical assistance, and a new Regional Economic Development Lite Program that offers communities with education about economic development and the tools necessary to address their economic development needs. Below are a list of services SENDD provides –

- Revolving Loan Funds

SENDD provides loans and financial packaging assistance to businesses throughout the 16-county region. The Revolving Loan Funds were funded by USDA – Rural Development and the US Economic Development Administration (EDA) and offer favorable interest rates and terms per the programs’ guidelines. Click the RLF button above to learn more about SENDD’s loan fund programs. - Technical Assistance for Business Startups and Expansions

SENDD connects business startups and expansions to resources, such as local economic development organizations, Southeast Community College’s Entrepreneurship Center, and the Nebraska Business Development Center, which has trained staff to coach and provide businesses with technical assistance, such as business planning, financial projections, determining legal structure, succession planning, etc. - Economic Development & Leadership Certified Community

Communities can contract with SENDD to assist with the applications to the Economic Development and Leadership Certified Community, two programs sponsored by the Nebraska Diplomats. More information about the two programs can be found at www.opportunity.nebraska.gov/programs/community - Economic Development Curriculum & Toolkit

In the summer of 2023, SENDD launched a program called the Regional SENDD Economic Development Lite Program that provides communities with the tools and resources they need to address economic development opportunities. Click on the ED Lite button above to learn more about how your community can participate in this program.

SENDD provides loans and financial packaging assistance to businesses throughout the 16-county region. The Revolving Loan Funds were funded by USDA – Rural Development and the US Economic Development Administration (EDA) and offer favorable interest rates and terms per the programs’ guidelines.

The primary goal of the fund is to provide financing and/or refinancing for start-up and existing businesses that cannot obtain sufficient conventional financing or to attract new businesses. Eligible businesses include manufacturing, service, telecommunication, food-based, childcare, retail, agricultural, etc.

Loan activities may include acquisition, construction or renovation, working capital, equipment/ machinery, public infrastructure, etc. Loan amounts may not exceed $200,000 and cannot be lower than $50,000. Terms will be determined based on the loan activity. Interest rates charged are at least 75% of the current Wall Street Journal Prime Rate.

To determine if your project is eligible for a SENDD loan, please complete the pre-application and submit to the loan officer. You will be contacted within seven days after the pre-application is submitted. If eligible, you will be invited to fill out the full application.

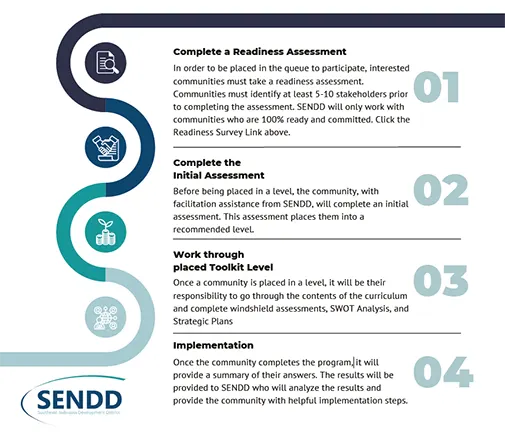

In the summer of 2023, SENDD launched a program called the Regional SENDD Economic Development Lite Program that provides community leaders with the tools and resources they need to address economic development opportunities. Utilizing funds from the U.S. Economic Development Administration, SENDD created the online tool that allows community leaders to gauge where they stand with improving the economic well-being and quality of life for their town.

The first step is easy, just take a readiness assessment to determine the level of commitment and identify key stakeholders who will go through the program. This assessment will go to SENDD staff, who will work with the primary point of contact to schedule an initial launch meeting where together, the stakeholders and SENDD staff will go through the initial assessment that places the community at a certain level. Once the community is placed in a level, they will work independently from SENDD to answer the questions within that level and complete necessary windshield assessments. Once that level has been completed, the results will be shared with SENDD, who will return to the community to assist with implementation. SENDD will work with four communities per year (one per quarter).

Amanda North

Loan Officer | Economic Development Specialist